Moscow: Oil Town

Petrodollars are fueling an unprecedented—but precarious—prosperity in Russia’s capital.

Guy Sorman

Autumn 2007

Those who knew the Soviet Union before 1991 agree that Moscow is a happier place today. In the old days, the city wore a dark, brooding look. People were poor and afraid; the ruble was worthless, though there was nothing to buy anyway. Imperial Moscow boasted two, perhaps three, restaurants, offering meager fare. The only ones to ply a trade were watchmakers, who made their living repairing old watches—a telling sign of the low level of consumption and innovation. Soviet Russia manufactured weapons, and little else.

In just 15 years, Moscow has transformed completely. Restaurants, bars, and hotels overflow with people, day and night. Gilded youth and nouveaux riches flaunt their wealth and expensive cars. French and Italian luxury goods adorn the shops on Pushkin Square and Tverskaya Street. The roads, once empty save the occasional official limousine, surge with traffic.

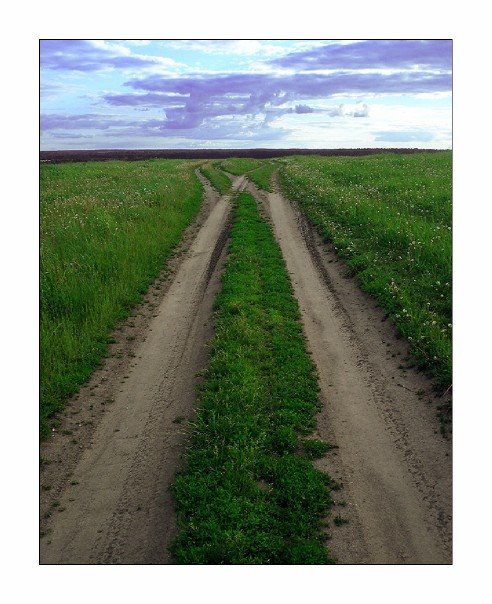

The money from oil, gas, and raw materials is flowing freely, driving this revolution. The biggest gainers, those at the top of the pyramid, are the officials, bureaucrats, and merchants who are part of the export network. Prosperity has trickled down, though, and many Russians have benefited. In 2006, median wages rose by more than 20 percent and the country posted 7 percent growth. Only those living in smaller towns and in the countryside, which still hasn’t recovered from the trauma of agricultural privatization during the nineties, have been left out, Yegor Gaidar informs me.

Gaidar, Boris Yeltsin’s prime minister in 1992 and the architect of Russian privatization, insists that soaring oil and gas prices aren’t the sole reasons for Russia’s economic recovery—indeed, he points out, the recovery began before the oil boom, thanks to the Russian spirit of enterprise and the introduction of the free market. Gaidar famously went in for “shock therapy,” lightning-swift privatization, rather than gradual change. Russians hold him responsible for the disruptions and poverty of the nineties, though it’s unfair to paint him as a villain. He was just the doctor, summoned to do something for an economy in its death throes. His sale of state assets was an attempt at a cure, not the illness.

People tend to forget that Yeltsin had inherited an economy almost wholly dependent on oil. Russia, Gaidar reminds me, could only feed her people by importing food in exchange for oil, a choice made in the twenties after Stalin’s collectivization destroyed the country’s agriculture. As energy prices plummeted in the eighties, Mikhail Gorbachev drove the country deep into debt to maintain food-subsistence levels. When Yeltsin came to power in 1991, Russia stood on the brink of famine, in no position to pay back her debts. The economy had ground to a halt, and oil production was dwindling. It was only after Gaidar’s privatization that production picked up. True, the so-called oligarchs—the well-connected elites of Russia—made a killing, buying state enterprises for a song. Yet they also put the economy back on track. “Their enterprise,” says Gaidar, “saved Russia.”

So is Russia truly a market economy? “We’re almost there,” says Arkady Dvorkovitch, President Vladimir Putin’s 35-year-old economic advisor. Trained in the United States, he has become the icon of the new generation in power. “We still do not have an independent judiciary,” he admits, “nor do we have genuine rule of law and officials who apply the rules rather than embezzle funds”, “almost there” suddenly seeming quite a ways off.

No business can function in Russia without official protection, or having a “roof,” in local parlance. The protection comes at a price, yet foreign investment pours in, proof that, corruption notwithstanding, profits are healthy. Like Gaidar, Dvorkovitch praises the Russian spirit of enterprise. But once you look beyond restaurants, shops, and real estate, I remark, there’s little investment: just 20 percent of national wealth. “It will come, things are happening very fast,” responds Dvorkovitch. The Russians, he claims, are just beginning to have faith in the stability of the new economy; credit based on predictable rules has only just started. But there’s no going back, Dvorkovitch maintains: no one wants a return to socialism. As in the West, the debate is about the role of the state in the market system.

Dvorkovitch would like to see greater market autonomy in investment decisions, rather than the state’s making so many major investments. Despite all the privatizing of the nineties, the state is still heavily involved in the economy—and in the energy sector, it has been retaking control from private companies, both Russian and international. The national ventures are hardly role models when it comes to investment strategy. State-run energy giant Gazprom, for instance, finds it more lucrative to invest its money in the financial market than to explore for new reserves or improve its technology. “It will happen,” asserts Dvorkovitch yet again. “President Putin is keen on investing in new sectors like petrochemicals, food processing, biotechnology, and IT,” he adds, doing his best to sound convincing.

Putin may decree, but nothing happens on the ground,” says former finance minister Yevgeny Yasin. The Russian president, he tells me, thinks that it’s enough to allocate public money for a sector to develop, as if by magic. Putin has yet to realize that in a market economy, development requires an institutional framework. “There can be no major innovation,” Yasin explains, “as long as there is no rule of law and when entrepreneurs who refuse to kowtow to the establishment risk being put behind bars.” Yasin calls the surfeit of oil and gas “the resource curse”; it exonerates both the Russian leadership and people from thinking about needed reforms.

How long will the oil boom last? Forever—or that’s what the current Russian leadership seems to think. The growth potential of China and India has convinced them that oil prices can only rise further, to Russia’s great benefit. When I raise the specter of global warming and the policy response to it, which could result in lower oil and gas consumption, my Russian interlocutors laugh. This is a debate fabricated in the United States, they explain, and it doesn’t cut much ice with the Indians and Chinese—and, in any case, Russian climatologists don’t subscribe to the global warming theory. “Hasn’t Russia ratified the Kyoto Convention on the limiting of greenhouse gases?” I ask. Dvorkovitch is dismissive: it was merely a political gesture.

Economist Vladimir Milov belongs to the same generation as Dvorkovitch, but he chose to leave the government on moral grounds. Unable to accept the high-oil-price way of thinking, Milov spoke his mind, a heroic feat under a regime intolerant of criticism. He succeeded in setting up an energy consultancy, which initiates foreign clients into the mysteries of Russian politics.

“Marxism is very useful in understanding the political life and ideological development of Russia,” Milov observes, aware of the irony. According to Marxism, the economic base determines the ideological superstructures. When Putin took office in 1999, Milov points out, energy prices were low, and the president happily adopted a liberal line and left things to civil society. As soon as energy prices began to rise, and it appeared that they would continue rising for a long time, however, Putin started renationalizing parts of the economy, taking over the media, and restoring to the bureaucracy and the FSB (formerly the KGB) all their old powers.

Oil may prop up the Russian economy, but no market can stay on a rising curve forever, Milov concludes. Sooner or later, prices will begin to fall. As things stand, Russia will not be able to cope.

The sale of oil and gas brings in $150 billion every year; arms sales, a mere $6 billion. Is the oil boom a new Russian curse, or a restoration of national sovereignty? Moscow’s youth lives it up. But some Russians believe that the KGB has never really left the dreaded Lubianka, the city’s dark heart.

In 1991, the people pulled down the statue of Felix Djerzinski, the founder of the KGB. Since then, it has lain on its side in the courtyard of Moscow’s Museum of Modern Art, corroded and covered with weeds. In the same museum, a retrospective is devoted to Oleg Kulik, a video artist who epitomizes new Russian art. Kulik became famous after he walked naked on the streets of Moscow, wearing only a necklace, barking or jumping on passersby to lick or bite them. “Today,” Kulik says, “Russian artists have complete freedom to do what they want—provided that they don’t criticize Putin or the Orthodox Church.”

Thus Moscow 2007: newly prosperous, only partially free—and precarious.

Guy Sorman is the author of numerous books, including The Empire of Lies, forthcoming from Encounter. He lives in Paris and is the president of the publishing house Éditions Sorman.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment